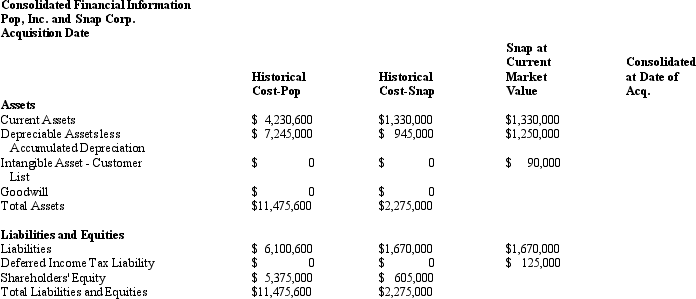

Pop,Inc.acquires 100% of the outstanding shares of Snap Corp.for $3,923,450 and accounts for the transaction using the purchase method.The purchase price Pop paid for Snap exceeded Snap's book value for four reasons:

1.Snap's long-term depreciable assets have a market value of $1,250,000.

2.Deferred income taxes of $125,000 arise from the excess of market value over the book value of the depreciable assets.

3.Pop assigns a value of $90,000 to Snap's customer list and records it as an intangible asset.

4.Goodwill exists equal to the difference between the acquisition cost and the market value of the identifiable assets and liabilities acquired.

Information about Pop and Snap's balance sheet at the acquisition date and the current market value of Snap's assets appears below:

Required: Complete the table for Snap's current market values and the consolidated amounts at the date of acquisition.

Required: Complete the table for Snap's current market values and the consolidated amounts at the date of acquisition.

Correct Answer:

Verified

Q84: Stock Trader,Inc.began operations in 2012.Stock Trader has

Q85: Interpretation No.46R relates to the issue of

Q86: Examine the five following cases and determine

Q87: Caruso Company incurred the following costs during

Q91: United owns Estada,a European based subsidiary for

Q92: On January 1,2012,Brock Company purchased $200,000,8% bonds

Q93: Carlson Company began constructing a building for

Q95: Buchaneer Co.,a waste collection company,estimates that its

Q95: The three types of costs incurred in

Q96: For some transactions U.S.GAAP requires that value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents