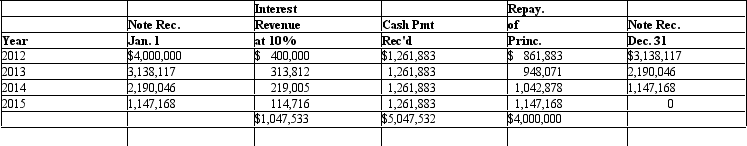

Parnell Industries Parnell Industries sold a copy machine to Ranger Inc.on January 1,2012.The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture.Ranger will make four payments at the end of each year,beginning with 2012,of $1,261,883 each.The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000.An amortization table appears below: If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the installment method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the installment method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

Correct Answer:

Verified

Q25: Dividing a company's income tax expense by

Q27: Deferred tax assets result in future tax

Q34: The _ is equal to the actuarial

Q48: U.S.GAAP requires firms to report the assets

Q51: Deferred tax liabilities result in future tax

Q54: Funtime Corporation Assume that Funtime Corp.has agreed

Q55: _ over sufficiently long time periods equals

Q55: Derivative instruments acquired to hedge exposure to

Q59: Funtime Corporation Assume that Funtime Corp.has agreed

Q63: A company may try to paint a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents