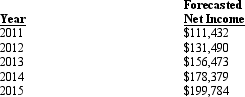

Booker,Inc.is a distributor of building supplies.Management for the company has developed the following forecasts of net income:

Management expects net income to grow at a rate of 7 percent per year after 2015 and the company's cost of equity capital is 14%.Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy.Booker's common shareholders' equity at January 1,2011 is $544,902.

Management expects net income to grow at a rate of 7 percent per year after 2015 and the company's cost of equity capital is 14%.Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy.Booker's common shareholders' equity at January 1,2011 is $544,902.

Required:

a.Using the residual income model,compute the value of Booker as of January 1,2011.

b.Using the dividend discount model,compute the value of Booker as of January 1,2011.

In both cases use the half-year convention.

Correct Answer:

Verified

Q48: Clean surplus accounting means that net income

Q50: Investors have invested $25,000 in common equity

Q58: _ means that net income includes all

Q58: Provide the intuition for the residual income

Q61: Porter,Inc.is a distributor of electrical supplies.Management for

Q61: Why is it appropriate to use the

Q65: The following data represent total assets,book value,and

Q65: If the firm competes in a very

Q66: Todd Corp.manufactures train components.On January 1,2011,management provided

Q67: Explain residual income.What does residual income represent?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents