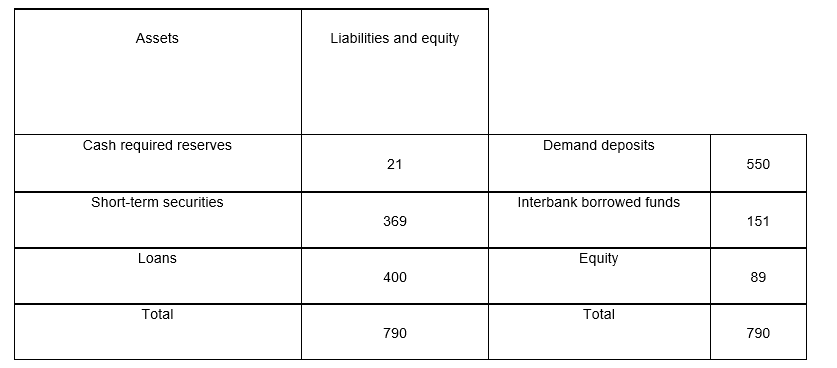

Use the following balance sheet (values in thousands of dollars) to answer the question.  If the bank experiences a $50 000 sudden liquidity drain caused by withdrawal of their demand deposits, what will be the impact on the balance sheet if purchased liquidity management techniques are used?

If the bank experiences a $50 000 sudden liquidity drain caused by withdrawal of their demand deposits, what will be the impact on the balance sheet if purchased liquidity management techniques are used?

A) A reduction in cash of $21 000 and a decrease in demand deposits of $29 000.

B) A reduction in securities and/or current loans totalling $50 000.

C) A reduction in demand deposits of $50 000 and an increase in interbank borrowings of $50 000.

D) A decrease in equity of $50 000.

Correct Answer:

Verified

Q30: A contagious run, or bank panic, differs

Q44: In practice, an FI that has 15

Q46: Liquidity risk can only arise on the

Q55: As part of the Basel III liquidity

Q58: Use the following balance sheet (values in

Q67: What are the main components of a

Q69: Distinguish between liquidity risk arising from the

Q70: Discuss the advantages and disadvantages of stored

Q76: Trend liquidity planning calculates an FI's liquidity

Q96: Consider a mutual fund with 100 shareholders

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents