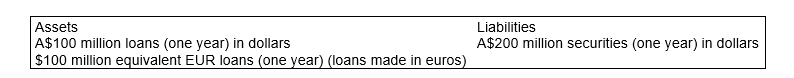

Suppose an FI has the following assets and liabilities: To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

To invest $100 million of the $200 million securities in one-year euro loans, the Australian FI engaged in the following transactions:

At the beginning of the year, it sold $100 million for euros on the spot currency markets at an exchange rate of A$2 to €1.

It takes the equivalent euro amount and makes one-year euro loans at a 15 per cent interest rate.

At the end of the year, the Australian FI repatriates the funds back to Australia at the same spot currency market rate of A$2/ €1.

a) Calculate the equivalent euro amount of $100 million using the spot exchange rate stated in transaction (1).

b) Calculate the value of the euro assets at the end of the year.

c) Calculate the dollar proceed of the euro investment.

d) Assume that the A$100 million loans yield a rate of 10 per cent p.a. What is the FI's weighted return on investments?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: A positive net exposure position in FX

Q52: Off-balance-sheet hedging involves making changes in the

Q54: A US FI wishes to hedge a

Q59: Which of the following FX trading activities

Q61: Explain the concept of the interest rate

Q64: Explain how forward contracts can be used

Q66: In a currency swap it is usual

Q70: An FI usually creates an open position

Q72: The interest rate parity theorem implies that

Q74: Good managers can know in advance what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents