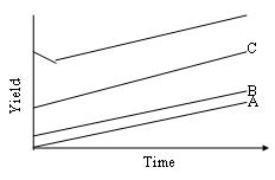

Represented below are yield curves for the following securities:

i.Bank-accepted bills

ii.Treasury notes

iii.Promissory notes

iv.Negotiable certificates of deposit  Based on your understanding of the risk structure of interest rates,rank the securities in order from curve A to curve D.

Based on your understanding of the risk structure of interest rates,rank the securities in order from curve A to curve D.

A) i, ii, iv, iii

B) ii, i, iv, iii

C) ii, iv, i, iii

D) iv, ii, iii, i

Correct Answer:

Verified

Q69: The term structure of interest rates describes

Q91: According to the liquidity premium theory of

Q92: Using the pure expectations approach to the

Q94: Unsecured notes are generally:

A) more risky than

Q95: According to expectations theory of term structure,a

Q97: According to the loanable funds approach,the supply

Q98: Generally,an increase in default risk will result

Q99: The risk structure of interest rates describes

Q100: As a factor explaining yield differences between

Q101: Define and discuss briefly the three common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents