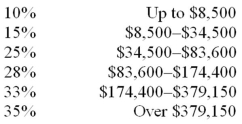

Using the following table,calculate the taxes for an individual with taxable income of $30,000.

A) $850

B) $2,125

C) $4,075

D) $4,500

E) $6,025

Correct Answer:

Verified

Q66: At the end of the year, Xavier

Q78: Recent tax credits include all of the

Q79: Tax resources include all of the following

Q80: Who is ultimately responsible for supplying accurate

Q81: An advantage of investing in a 401(k)plan

Q84: Identify and provide examples of four types

Q86: Janet is completing her federal income taxes

Q87: Sam and Diane are completing their federal

Q88: The maximum that an individual can contribute

Q101: If Diane was in a 25% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents