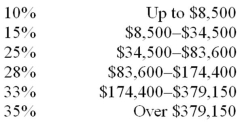

Using the following table,calculate the taxes for an individual with taxable income of $45,000.

A) $6,025

B) $7,375

C) $8,625

D) $20,900

E) $45,000.

Correct Answer:

Verified

Q82: All of the following can reduce your

Q84: Which of the following is NOT an

Q86: Janet is completing her federal income taxes

Q87: Sam and Diane are completing their federal

Q88: The maximum that an individual can contribute

Q89: Describe the calculation for adjusted gross income.

Q90: If Jack was in a 25% tax

Q93: The maximum that an individual can contribute

Q95: Using the following table,calculate the taxes for

Q102: George Franklin paid taxes of $4,375 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents