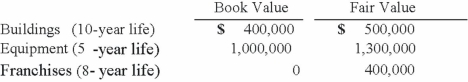

On January 3, 2013, Austin Corp. purchased 25% of the voting common stock of Gainsville Co., paying $2,500,000. Austin decided to use the equity method to account for this investment. At the time of the investment, Gainsville's total stockholders' equity was $8,000,000. Austin gathered the following information about Gainsville's assets and liabilities:  For all other assets and liabilities, book value and fair value were equal. Any excess of cost over fair value was attributed to goodwill, which has not been impaired. What is the amount of goodwill associated with the investment?

For all other assets and liabilities, book value and fair value were equal. Any excess of cost over fair value was attributed to goodwill, which has not been impaired. What is the amount of goodwill associated with the investment?

A) $500,000.

B) $200,000.

C) $0.

D) $300,000.

E) $400,000.

Correct Answer:

Verified

Q1: On January 4, 2013, Watts Co. purchased

Q2: On January 1, 2013, Bangle Company purchased

Q8: An upstream sale of inventory is a

Q9: Yaro Company owns 30% of the common

Q17: Atlarge Inc. owns 30% of the outstanding

Q20: On January 3, 2013, Austin Corp. purchased

Q27: When an investor sells shares of its

Q33: On January 1, 2012, Dawson, Incorporated, paid

Q38: On January 1, 2012, Dawson, Incorporated, paid

Q40: Dodge, Incorporated acquires 15% of Gates Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents