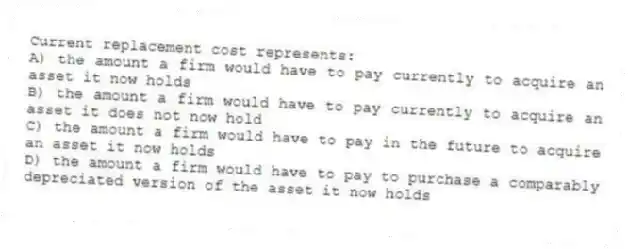

Current replacement cost represents:

A) the amount a firm would have to pay currently to acquire an asset it now holds

B) the amount a firm would have to pay currently to acquire an asset it does not now hold

C) the amount a firm would have to pay in the future to acquire an asset it now holds

D) the amount a firm would have to pay to purchase a comparably depreciated version of the asset it now holds

Correct Answer:

Verified

Q8: Permanent tax differences are revenues and expenses:

A)

Q9: When income tax expense for a period

Q10: Shareholders' equity consists of what three components:

A)

Q11: Which of the following transactions is consistent

Q12: Which of the following valuation methods reflects

Q14: The net amount a firm would receive

Q15: Future taxable income is characteristic of all

Q16: Firms use acquisition cost valuations and adjusted

Q17: The traditional accounting model delays the recognition

Q18: The use of acquisition cost as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents