The following problem requires present value information:

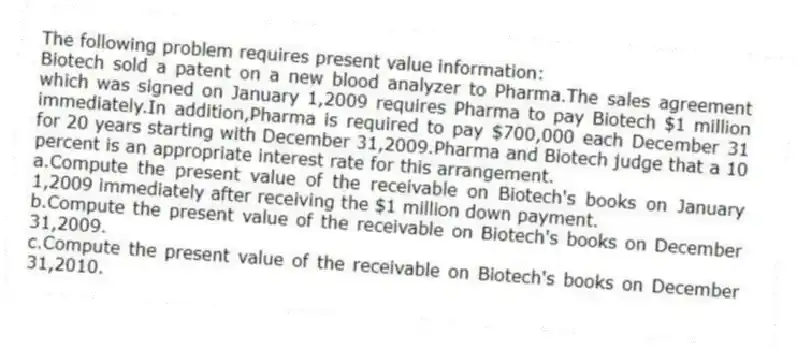

Biotech sold a patent on a new blood analyzer to Pharma.The sales agreement which was signed on January 1,2009 requires Pharma to pay Biotech $1 million immediately.In addition,Pharma is required to pay $700,000 each December 31 for 20 years starting with December 31,2009.Pharma and Biotech judge that a 10 percent is an appropriate interest rate for this arrangement.

a.Compute the present value of the receivable on Biotech's books on January 1,2009 immediately after receiving the $1 million down payment.

b.Compute the present value of the receivable on Biotech's books on December 31,2009.

c.Compute the present value of the receivable on Biotech's books on December 31,2010.

Correct Answer:

Verified

The present value of an ordi...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Accord Inc.income tax return shows taxes currently

Q66: The financial statement disclosures for Able

Q67: H.Solo Company purchased a new piece of

Q68: For some transactions GAAP requires that value

Q69: Discuss the two principal reasons income before

Q71: On January 1,2010,Starlight Company's balance sheet reported

Q72: The analytical framework used to evaluate

Q73: On December 31,2009,Loran Corporation reported a deferred

Q74: a.Plaxo Corporation has a tax rate of

Q75: Jurgen Company's income tax return shows income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents