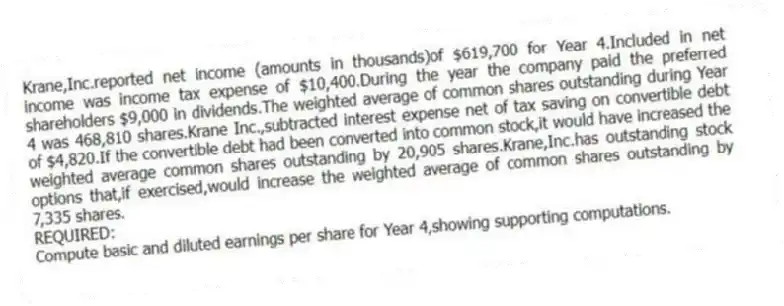

Krane,Inc.reported net income (amounts in thousands)of $619,700 for Year 4.Included in net income was income tax expense of $10,400.During the year the company paid the preferred shareholders $9,000 in dividends.The weighted average of common shares outstanding during Year 4 was 468,810 shares.Krane Inc.,subtracted interest expense net of tax saving on convertible debt of $4,820.If the convertible debt had been converted into common stock,it would have increased the weighted average common shares outstanding by 20,905 shares.Krane,Inc.has outstanding stock options that,if exercised,would increase the weighted average of common shares outstanding by 7,335 shares.

REQUIRED:

Compute basic and diluted earnings per share for Year 4,showing supporting computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Examine the four following conditions involving

Q84: Carridine Company reported net income of $1,903

Q85: Below are three relationships that are

Q86: Freedom Company reported net income for 2010

Q87: Use the following information about Sanibel

Q89: Sensitron and Douglas Tools manufacture and

Q90: The following balance sheets and income

Q91: Below is financial information for two

Q92: Discuss the economic characteristics of firms that

Q93: Sensitron and Douglas Tools manufacture and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents