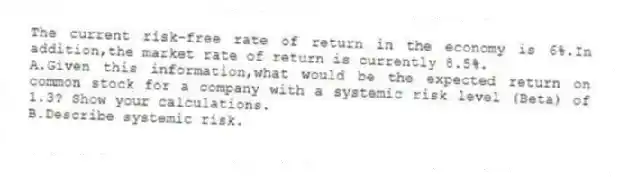

The current risk-free rate of return in the economy is 6%.In addition,the market rate of return is currently 8.5%.

A.Given this information,what would be the expected return on common stock for a company with a systemic risk level (Beta) of 1.3? Show your calculations.

B.Describe systemic risk.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Caraway Company's net accounts receivable was $300,000

Q67: Refer to the financial statement data

Q68: Below is selected data of Pronto

Q69: Below is information from Darren Company's

Q70: One criticism of the interest and fixed

Q72: Working capital is defined as _ minus

Q73: For each of the following scenarios,determine if

Q74: A.Hammer Corporation wrote off $185,000 of obsolete

Q75: Bragdon Company is consistently profitable.Its normal

Q76: Foxmoor Company's merchandise inventory and other

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents