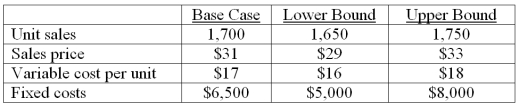

You are analyzing a project and have developed the following estimates. The depreciation is $4,200 a year and the tax rate is 34 percent. What is the best case operating cash flow?

A) $13,473

B) $14,196

C) $15,280

D) $17,027

E) $17,763

Correct Answer:

Verified

Q93: A project has an initial requirement of

Q94: Three years ago, Hi Tek purchased some

Q95: You are analyzing a project and have

Q97: Lakeside Winery is considering expanding its wine-making

Q99: You are analyzing a project and have

Q101: Your firm is contemplating the purchase of

Q102: Consider an asset that costs $459,000 and

Q103: Consider a 3-year project with the following

Q110: Explain the concept of incremental cash flow

Q111: Explain the difference between scenario analysis and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents