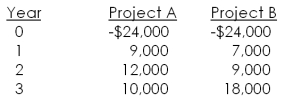

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what is the best reason for that decision?

A) Project A; because it pays back faster

B) Project A; because it has the higher profitability index

C) Project B; because it has the higher profitability index

D) Project A; because it has the higher net present value

E) Project B; because it has the higher net present value

Correct Answer:

Verified

Q79: What is the payback period for a

Q80: The Blue Goose is considering a project

Q81: Diamond Enterprises is considering a project that

Q82: You are considering the following two mutually

Q83: A project has expected cash inflows, starting

Q85: A firm is reviewing a project that

Q87: A project has the following cash flows.

Q88: Soft and Cuddly is considering a new

Q89: Miller Brothers is considering a project that

Q89: The Flour Baker is considering a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents