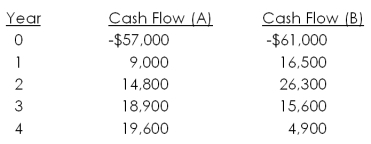

Baker's Supply imposes a payback cutoff of 3.5 years for its international investment projects. If the company has the following two projects available, should it accept either of them?

A) Accept both Projects A and B

B) Accept Project A but not Project B

C) Accept Project B but not Project A

D) Both Project A and B are acceptable but you can only select one project

E) Reject both Projects A and B

Correct Answer:

Verified

Q101: Ed has to choose between Project A

Q104: In words,explain how the crossover rate is

Q105: Jefferson International is trying to choose between

Q106: What is the NPV of the following

Q107: Quattro, Inc. has the following mutually exclusive

Q108: Textiles Unlimited has gathered projected cash flows

Q110: Consider the following two mutually exclusive projects:

Q111: Chestnut Tree Farms has identified the following

Q112: You're trying to determine whether or not

Q113: What is the IRR of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents