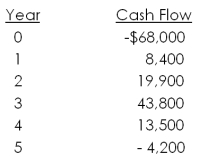

Miller and Sons is evaluating a project with the following cash flows:  The company uses a 10 percent interest rate on all of its projects. What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

The company uses a 10 percent interest rate on all of its projects. What is the MIRR of the project using the reinvestment approach? The discounting approach? The combination approach?

A) 8.46 percent; 7.29 percent; 8.59 percent

B) 8.46 percent; 7.38 percent; 8.61 percent

C) 8.54 percent; 7.29 percent; 8.61 percent

D) 8.54 percent; 7.38 percent; 8.59 percent

E) 8.54 percent; 8.23 percent; 8.61 percent

Correct Answer:

Verified

Q84: The net present value of a project's

Q97: You are considering the following two mutually

Q98: A project has the following cash flows.

Q100: Identify one primary strength and one primary

Q101: Ed has to choose between Project A

Q105: Explain why the net present value is

Q105: Jefferson International is trying to choose between

Q106: What is the NPV of the following

Q107: Quattro, Inc. has the following mutually exclusive

Q109: The present value of the benefits of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents