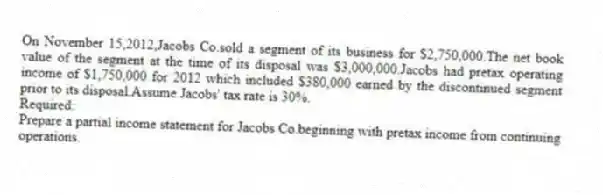

On November 15,2012,Jacobs Co.sold a segment of its business for $2,750,000.The net book value of the segment at the time of its disposal was $3,000,000.Jacobs had pretax operating income of $1,750,000 for 2012 which included $380,000 earned by the discontinued segment prior to its disposal.Assume Jacobs' tax rate is 30%.

Required:

Prepare a partial income statement for Jacobs Co.beginning with pretax income from continuing operations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: On July 15,2009 Time Services decided to

Q66: Many times an analyst will have to

Q67: Healy and Wahlen state that one type

Q68: For each of the following factors,determine

Q69: A.Listed below are 12 accounting liabilities:

1.Insurance

Q70: In the empirical research on earnings manipulation

Q72: On September 1,2012,Ramos Inc.approved a plan

Q73: Many users of financial statements believe that

Q74: Mattel,Inc.designs,manufactures and markets various toy products

Q75: Healy and Wahlen state that one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents