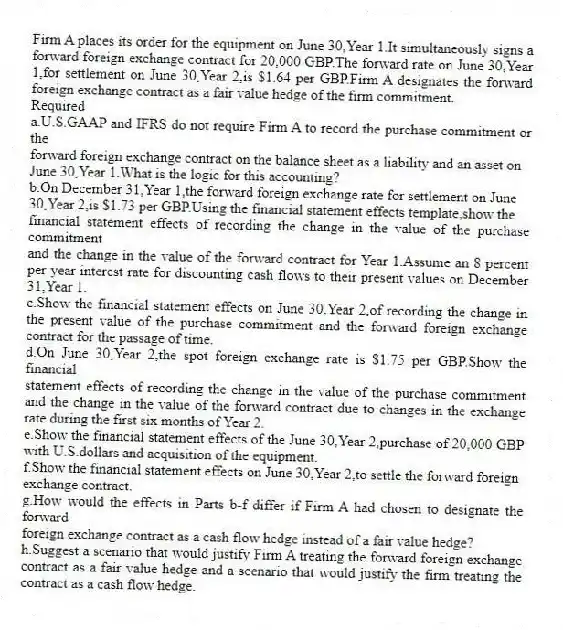

Firm A places its order for the equipment on June 30,Year 1.It simultaneously signs a forward foreign exchange contract for 20,000 GBP.The forward rate on June 30,Year 1,for settlement on June 30,Year 2,is $1.64 per GBP.Firm A designates the forward foreign exchange contract as a fair value hedge of the firm commitment.

Required

a.U.S.GAAP and IFRS do not require Firm A to record the purchase commitment or the

forward foreign exchange contract on the balance sheet as a liability and an asset on

June 30,Year 1.What is the logic for this accounting?

b.On December 31,Year 1,the forward foreign exchange rate for settlement on June

30,Year 2,is $1.73 per GBP.Using the financial statement effects template,show the

financial statement effects of recording the change in the value of the purchase commitment

and the change in the value of the forward contract for Year 1.Assume an 8 percent per year interest rate for discounting cash flows to their present values on December 31,Year 1.

c.Show the financial statement effects on June 30,Year 2,of recording the change in the present value of the purchase commitment and the forward foreign exchange contract for the passage of time.

d.On June 30,Year 2,the spot foreign exchange rate is $1.75 per GBP.Show the financial

statement effects of recording the change in the value of the purchase commitment and the change in the value of the forward contract due to changes in the exchange rate during the first six months of Year 2.

e.Show the financial statement effects of the June 30,Year 2,purchase of 20,000 GBP with U.S.dollars and acquisition of the equipment.

f.Show the financial statement effects on June 30,Year 2,to settle the forward foreign

exchange contract.

g.How would the effects in Parts b-f differ if Firm A had chosen to designate the forward

foreign exchange contract as a cash flow hedge instead of a fair value hedge?

h.Suggest a scenario that would justify Firm A treating the forward foreign exchange contract as a fair value hedge and a scenario that would justify the firm treating the contract as a cash flow hedge.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: One sign that a company may be

Q61: Assume that Madison Corp.has agreed to

Q62: The following information is available from

Q63: Cooke Industries imports and sells quality

Q64: Pronto,Inc.is a major producer of printing

Q66: Bower Construction Comp.has consistently used the

Q67: The following information is taken from

Q68: Under U.S.GAAP,application of the LIFO and FIFO

Q69: What are the four disclosures required by

Q70: The following information is related to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents