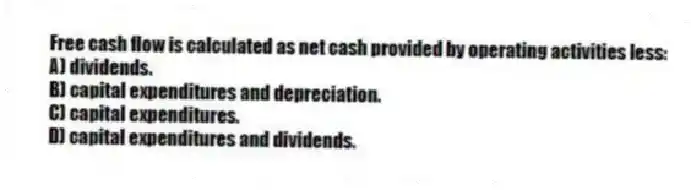

Free cash flow is calculated as net cash provided by operating activities less:

A) dividends.

B) capital expenditures and depreciation.

C) capital expenditures.

D) capital expenditures and dividends.

Correct Answer:

Verified

Q1: If an analyst wants to value a

Q2: Starting with net cash flow from operations

Q4: If an analyst wants to value a

Q5: If an analyst wants to value a

Q6: Continuing free cash flows represent:

A) the cash

Q7: Plough Corporation reports the following information:

Q8: A disadvantage of the free cash flow

Q9: If an analyst wants to value a

Q10: Houston, Inc.

The following information pertains to

Q11: Financial liabilities include all of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents