Simpson Department Store Simpson Department Stores Operates Retail Department Store Chains Throughout the Chains

Simpson Department Store

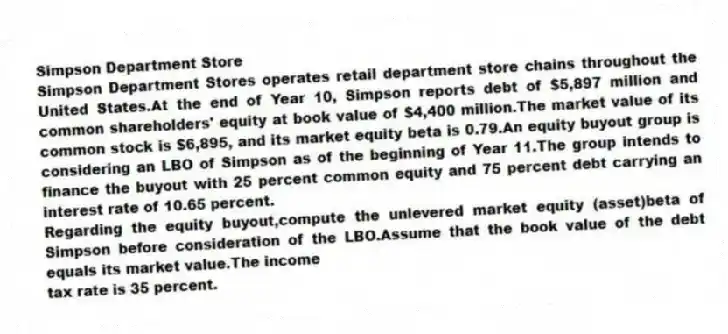

Simpson Department Stores operates retail department store chains throughout the United States.At the end of Year 10, Simpson reports debt of $5,897 million and common shareholders' equity at book value of $4,400 million.The market value of its common stock is $6,895, and its market equity beta is 0.79.An equity buyout group is considering an LBO of Simpson as of the beginning of Year 11.The group intends to finance the buyout with 25 percent common equity and 75 percent debt carrying an interest rate of 10.65 percent.

-Regarding the equity buyout,compute the unlevered market equity (asset)beta of Simpson before consideration of the LBO.Assume that the book value of the debt equals its market value.The income

tax rate is 35 percent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Even in relatively efficient securities markets,_ is

Q39: The cash-flow-based valuation approach measures and values

Q40: One advantage of the free cash flow

Q41: Shady Sunglasses operates retail sunglass kiosks

Q42: Simpson Department Store

Simpson Department Stores operates retail

Q44: Simpson Department Store

Simpson Department Stores operates retail

Q45: What is the purpose of a free

Q46: When should an analyst use nominal cash

Q47: Starting with free cash flows from operations,discuss

Q48: What three elements are needed to value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents