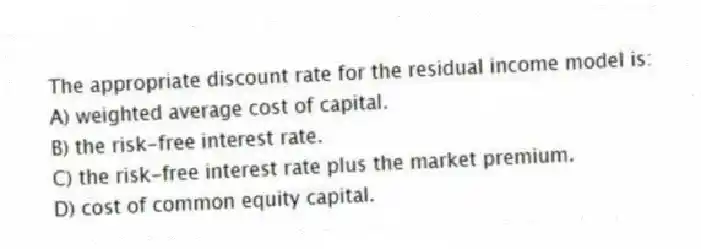

The appropriate discount rate for the residual income model is:

A) weighted average cost of capital.

B) the risk-free interest rate.

C) the risk-free interest rate plus the market premium.

D) cost of common equity capital.

Correct Answer:

Verified

Q11: If an analyst expects a firm to

Q12: Jarrett Corp.

At the end of 2010

Q13: Residual income valuation focuses on:

A) dividend-paying capacity

Q14: Residual income is:

A) adjusted net income the

Q15: Jarrett Corp.

At the end of 2010

Q17: Jarrett Corp.

At the end of 2010

Q18: Over the life of a firm,the capital

Q19: Residual income is the:

A) difference between the

Q20: Required earnings are the:

A) adjusted net income

Q21: Which of the following is probably the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents