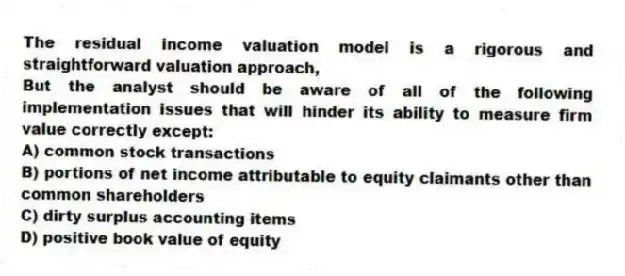

The residual income valuation model is a rigorous and straightforward valuation approach,

But the analyst should be aware of all of the following implementation issues that will hinder its ability to measure firm value correctly except:

A) common stock transactions

B) portions of net income attributable to equity claimants other than common shareholders

C) dirty surplus accounting items

D) positive book value of equity

Correct Answer:

Verified

Q21: Which of the following is probably the

Q22: The residual income _ valuation model uses

Q23: Dirty surplus items in U.S.GAAP typically arise

Q24: Early in a period in which sales

Q25: In theory,all three valuation models,when correctly implemented

Q27: Accounting principles make accrual accounting earnings closer

Q28: Economists sometimes argue that earnings are not

Q29: Which of the following would likely be

Q30: The foundation for residual income valuation is

Q31: _ is the amount by which expected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents