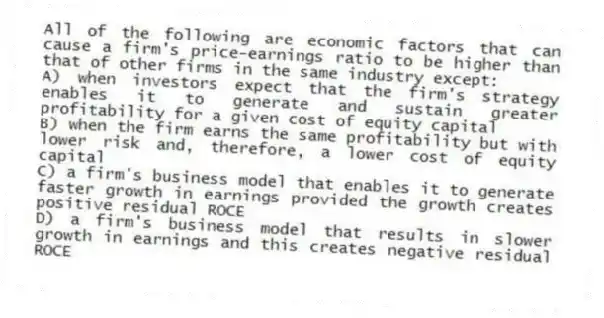

All of the following are economic factors that can cause a firm's price-earnings ratio to be higher than that of other firms in the same industry except:

A) when investors expect that the firm's strategy enables it to generate and sustain greater profitability for a given cost of equity capital

B) when the firm earns the same profitability but with lower risk and, therefore, a lower cost of equity capital

C) a firm's business model that enables it to generate faster growth in earnings provided the growth creates positive residual ROCE

D) a firm's business model that results in slower growth in earnings and this creates negative residual ROCE

Correct Answer:

Verified

Q28: The PE multiple assumes that firm value

Q29: The differences in industry market-to-book ratios may

Q30: The _ represents the value of the

Q31: Industries with relatively high market-to-book ratios are

Q32: The value-to-book ratio reflects an analyst's expectation

Q34: The theoretical PE model does not work

Q35: Which of the following ratios give a

Q36: All of the following are economic factors

Q37: All of the following are accounting factors

Q38: Analysts use the PEG ratio to assess

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents