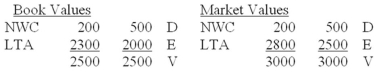

Bombay Company's book and market value balance sheets are:

(NWC = net working capital; LTA = long term assets; D = debt; E = equity; V = firm value) :

According to MM's Proposition I corrected for taxes,what will be the change in company value if Bombay issues $200 of equity and uses it to make a permanent reduction in the company's debt? Assume a 35% marginal corporate tax rate.

A) +$140

B) +$70

C) $0

D) -$70

Correct Answer:

Verified

Q2: Given corporate taxes, why does adding debt

Q4: For every dollar of operating income paid

Q6: If a firm borrows $50 million for

Q6: MM's Proposition I corrected for the inclusion

Q7: If a corporation cannot use its interest

Q8: If a firm permanently borrows $50 million

Q10: Assume the marginal corporate tax rate is

Q11: If a firm borrows $50 million for

Q13: If a firm permanently borrows $100 million

Q17: In order to calculate the tax shields

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents