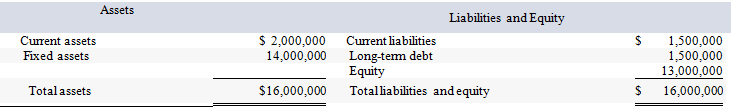

Suppose that Gyp Sum Industries currently has the balance sheet shown as follows, and that sales for the year just ended were $20 million. The firm also has a profit margin of 22 percent, a retention ratio of 42 percent, and expects sales of $30 million next year. If all assets and current liabilities are expected to grow with sales, how much additional funds will Gyp Sum need from external sources to fund the expected growth?

A) $3,925,000

B) $3,695,000

C) $4,124,000

D) $4,478,000

Correct Answer:

Verified

Q30: Suppose a firm has had the historical

Q31: Suppose a firm has had the historical

Q32: Suppose a firm has had the historical

Q33: Suppose that PBJ Industries, Inc. currently has

Q34: Suppose a firm has had the historical

Q36: Suppose a firm has had the historical

Q37: Suppose a firm has had the historical

Q38: Suppose that BBM Industries, Inc. currently has

Q39: Suppose a firm has had the historical

Q40: Suppose that the 2017 actual and 2018

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents