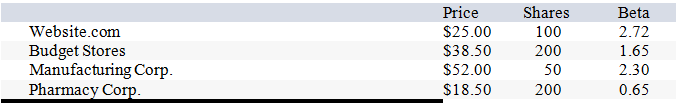

You hold the positions in the following table. If you expect the market to earn 10 percent and the risk-free rate is 3 percent, what is the required return of the portfolio?

A) 14.83 percent

B) 15.81 percent

C) 28.67 percent

D) 32.83 percent

Correct Answer:

Verified

Q86: In 2000, the S&P 500 Index earned

Q96: Whenever a set of stock prices go

Q101: You obtain beta estimates of General Electric

Q102: A company's current stock price is $50.00

Q104: Compute the expected return given these three

Q106: A stock has an expected return of

Q111: ABC Inc. has a dividend yield equal

Q112: You have a portfolio consisting of 20

Q113: Which of the following statements is correct?

A)

Q116: A company has a beta of 0.25.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents