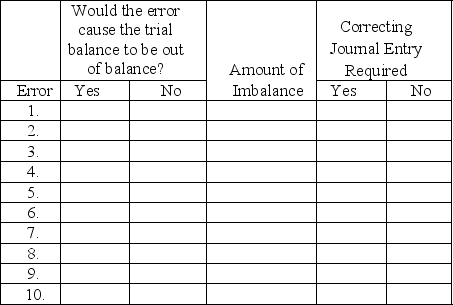

At year-end, Henry Laundry Service, Inc. noted the following errors in its trial balance:

1. It understated the total debits to the Cash account by $500 when computing the account balance.

2. A credit sale for $311 was recorded as a credit to the revenue account, but the offsetting debit was not posted.

3. A cash payment to a creditor for $2,600 was never recorded.

4. The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5. A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6. A purchase of office supplies for $150 was recorded as a debit to Office Equipment. The offsetting credit entry was correct.

7. An additional investment of $4,000 by Del Henry was recorded as a debit to Common Stock and as a credit to Cash.

8. The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9. The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10. A $1,000 cash withdrawal by the stockholder was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below, indicate whether each error would cause the trial balance to be out of balance, the amount of any imbalance, and whether a correcting journal entry is required.

Correct Answer:

Verified

Q171: Identify by marking an X in

Q174: Jarrod Automotive, Inc. owned and operated by

Q175: Larry Matt, Inc. completed these transactions

Q177: Jerry's Butcher Shop, Inc. had the

Q178: For each of the accounts in

Q180: Jerry's Butcher Shop, Inc. had the

Q181: The following trial balance is prepared

Q182: Rowdy Bolton began Bolton Office Services, Inc.

Q187: Explain the difference between a general ledger

Q202: List the four steps in recording transactions.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents