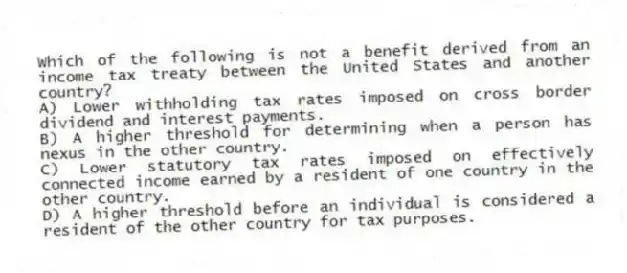

Which of the following is not a benefit derived from an income tax treaty between the United States and another country?

A) Lower withholding tax rates imposed on cross border dividend and interest payments.

B) A higher threshold for determining when a person has nexus in the other country.

C) Lower statutory tax rates imposed on effectively connected income earned by a resident of one country in the other country.

D) A higher threshold before an individual is considered a resident of the other country for tax purposes.

Correct Answer:

Verified

Q46: Hanover Corporation, a U.S. corporation, incurred $300,000

Q49: Which of the following tax rules applies

Q49: Which of the following expenses incurred by

Q51: Bismarck Corporation has a precredit U.S. tax

Q53: Absent a treaty provision, what is the

Q54: Manchester Corporation, a U.S. corporation, incurred $100,000

Q55: Provo Corporation, a U.S. corporation, received a

Q57: A U.S. corporation reports its foreign tax

Q66: Which of the following tax benefits does

Q68: What form is used by a U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents