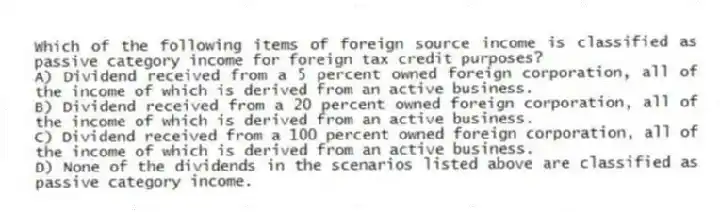

Which of the following items of foreign source income is classified as passive category income for foreign tax credit purposes?

A) Dividend received from a 5 percent owned foreign corporation, all of the income of which is derived from an active business.

B) Dividend received from a 20 percent owned foreign corporation, all of the income of which is derived from an active business.

C) Dividend received from a 100 percent owned foreign corporation, all of the income of which is derived from an active business.

D) None of the dividends in the scenarios listed above are classified as passive category income.

Correct Answer:

Verified

Q51: Bismarck Corporation has a precredit U.S. tax

Q53: Absent a treaty provision, what is the

Q54: Manchester Corporation, a U.S. corporation, incurred $100,000

Q55: Provo Corporation, a U.S. corporation, received a

Q57: A U.S. corporation reports its foreign tax

Q57: Boca Corporation, a U.S. corporation, reported U.S.

Q58: Which of the following tax or non-tax

Q59: Horton Corporation is a 100 percent owned

Q60: Pierre Corporation has a precredit U.S. tax

Q69: A rectangle with an inverted triangle within

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents