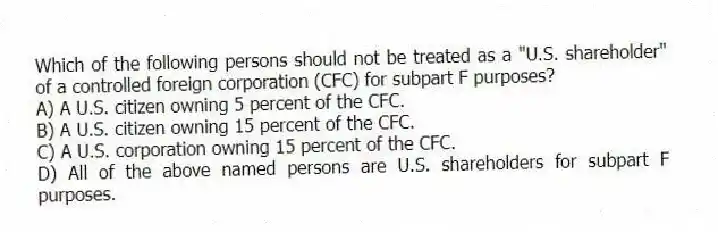

Which of the following persons should not be treated as a "U.S. shareholder" of a controlled foreign corporation (CFC) for subpart F purposes?

A) A U.S. citizen owning 5 percent of the CFC.

B) A U.S. citizen owning 15 percent of the CFC.

C) A U.S. corporation owning 15 percent of the CFC.

D) All of the above named persons are U.S. shareholders for subpart F purposes.

Correct Answer:

Verified

Q64: Which of the following transactions engaged in

Q65: Nicole is a citizen and resident of

Q67: Which of the following income earned by

Q69: Gouda, S.A., a Belgium corporation, received the

Q71: Reno Corporation, a U.S. corporation, reported total

Q72: Boomerang Corporation, a New Zealand corporation, is

Q73: Jesse Stone is a citizen and bona

Q74: Obispo, Inc., a U.S. corporation, received the

Q78: Which of the following exceptions could cause

Q79: Before subpart F applies, a foreign corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents