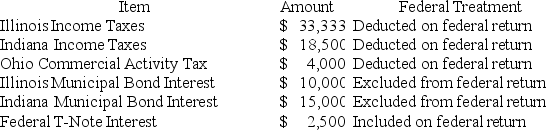

PWD Incorporated is an Illinois corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:  PWD's Federal Taxable Income was $100,000.Calculate PWD's Illinois state tax base.

PWD's Federal Taxable Income was $100,000.Calculate PWD's Illinois state tax base.

A) $116,000.

B) $130,833.

C) $131,000.

D) $164,333.

Correct Answer:

Verified

Q41: Most states have shifted away from an

Q43: Most services are sourced to the state

Q53: A gross receipts tax is subject to

Q56: The throwback rule requires a company,for apportionment

Q58: The payroll factor includes payments to independent

Q64: Mahre,Incorporated,a New York corporation,runs ski tours in

Q72: Bethesda Corporation is unprotected from income tax

Q73: What was the Supreme Court's holding in

Q74: Roxy operates a dress shop in Arlington,

Q78: What was the Supreme Court's holding in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents