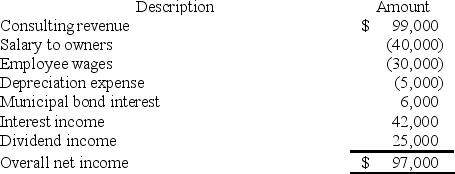

RGD Corporation was a C corporation from its inception in 2012 through 2016.However,it elected S corporation status effective January 1,2017.RGD had $50,000 of earnings and profits at the end of 2016.RGD reported the following information for its 2017 tax year.

What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: During 2017,MVC operated as a C corporation.However,it

Q122: SEC Corporation has been operating as a

Q123: MWC is a C corporation that uses

Q124: RGD Corporation was a C corporation from

Q125: During 2017,CDE Corporation (an S corporation since

Q127: Vanessa is the sole shareholder of V

Q128: During 2017,MVC operated as a C corporation.However,it

Q129: Hazel is the sole shareholder of Maple

Q130: Hector formed H Corporation as a C

Q131: During 2017,CDE Corporation (an S corporation since

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents