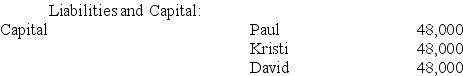

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000.Just prior to the sale,Paul's outside and inside bases in KDP are $48,000.KDP's balance sheet includes the following:

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

A) $0.

B) $36,000.

C) $12,000.

D) None of the choices are correct.

Correct Answer:

Verified

Q62: Brian is a 25% partner in the

Q63: Daniela is a 25% partner in the

Q64: Joan is a 1/3 partner in the

Q65: Which of the following statements regarding hot

Q65: Joan is a 30% partner in the

Q66: The VRX Partnership (a calendar year-end entity)has

Q68: Tyson is a 25% partner in the

Q69: The PW partnership's balance sheet includes the

Q71: Kathy is a 25% partner in the

Q72: Victor is a 1/3 partner in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents