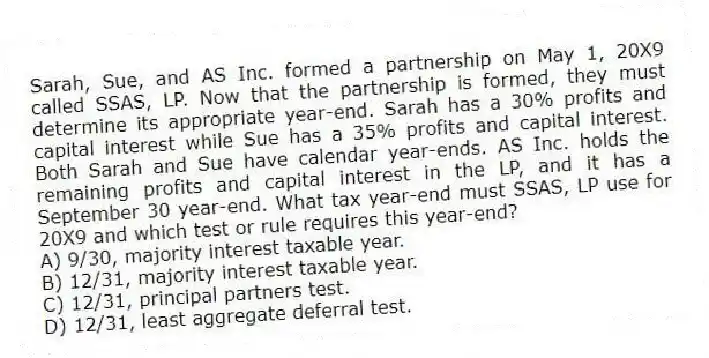

Sarah, Sue, and AS Inc. formed a partnership on May 1, 20X9 called SSAS, LP. Now that the partnership is formed, they must determine its appropriate year-end. Sarah has a 30% profits and capital interest while Sue has a 35% profits and capital interest. Both Sarah and Sue have calendar year-ends. AS Inc. holds the remaining profits and capital interest in the LP, and it has a September 30 year-end. What tax year-end must SSAS, LP use for 20X9 and which test or rule requires this year-end?

A) 9/30, majority interest taxable year.

B) 12/31, majority interest taxable year.

C) 12/31, principal partners test.

D) 12/31, least aggregate deferral test.

Correct Answer:

Verified

Q26: Tom is talking to his friend Bob,

Q27: Which of the following entities is not

Q28: Which of the following statements regarding capital

Q29: Erica and Brett decide to form their

Q30: In X1, Adam and Jason formed ABC,

Q33: The main difference between a partner's tax

Q35: A partner can generally apply passive activity

Q36: Which of the following does not represent

Q36: Zinc, LP was formed on August 1,

Q39: In what order should the tests to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents