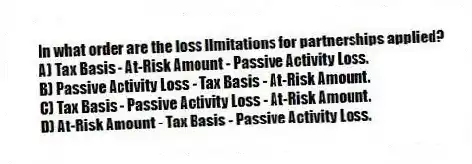

In what order are the loss limitations for partnerships applied?

A) Tax Basis - At-Risk Amount - Passive Activity Loss.

B) Passive Activity Loss - Tax Basis - At-Risk Amount.

C) Tax Basis - Passive Activity Loss - At-Risk Amount.

D) At-Risk Amount - Tax Basis - Passive Activity Loss.

Correct Answer:

Verified

Q48: Which requirement must be satisfied in order

Q64: Hilary had an outside basis in LTL

Q65: Which of the following statements regarding partnerships

Q66: Which of the following would not be

Q67: Which of the following items will affect

Q68: On January 1, X9, Gerald received his

Q69: What form does a partnership use when

Q69: Which of the following statements regarding the

Q77: What is the correct order for applying

Q95: What type of debt is not included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents