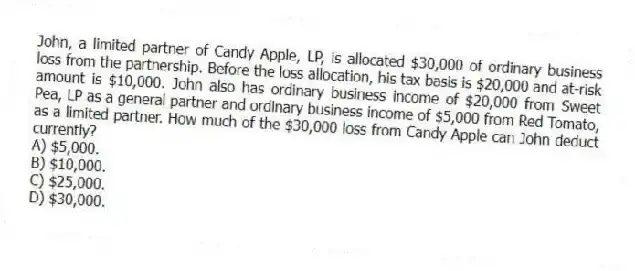

John, a limited partner of Candy Apple, LP, is allocated $30,000 of ordinary business loss from the partnership. Before the loss allocation, his tax basis is $20,000 and at-risk amount is $10,000. John also has ordinary business income of $20,000 from Sweet Pea, LP as a general partner and ordinary business income of $5,000 from Red Tomato, as a limited partner. How much of the $30,000 loss from Candy Apple can John deduct currently?

A) $5,000.

B) $10,000.

C) $25,000.

D) $30,000.

Correct Answer:

Verified

Q66: Which of the following would not be

Q67: Which of the following items will affect

Q68: On January 1, X9, Gerald received his

Q69: Which of the following statements regarding the

Q70: Which person would generally be treated as

Q71: Does adjusting a partner's basis for tax-exempt

Q72: Styling Shoes, LLC filed its 20X8 Form

Q73: What is the difference between the aggregate

Q73: How does additional debt or relief of

Q76: Which of the following statements regarding a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents