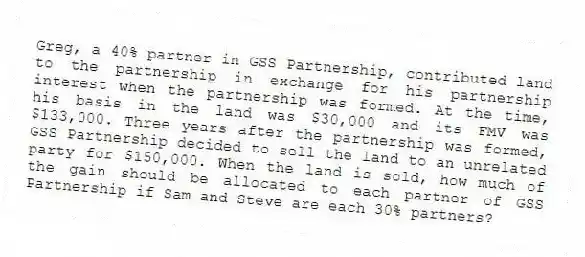

Greg, a 40% partner in GSS Partnership, contributed land to the partnership in exchange for his partnership interest when the partnership was formed. At the time, his basis in the land was $30,000 and its FMV was $133,000. Three years after the partnership was formed, GSS Partnership decided to sell the land to an unrelated party for $150,000. When the land is sold, how much of the gain should be allocated to each partner of GSS Partnership if Sam and Steve are each 30% partners?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: In each of the independent scenarios below,

Q94: ER General Partnership, a medical supplies business,

Q95: On March 15, 20X9, Troy, Peter, and

Q97: On March 15, 20X9, Troy, Peter, and

Q101: Fred has a 45% profits interest and

Q102: Clint noticed that the Schedule K-1 he

Q104: Peter, Matt, Priscilla, and Mary began the

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Q122: Bob is a general partner in Fresh

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents