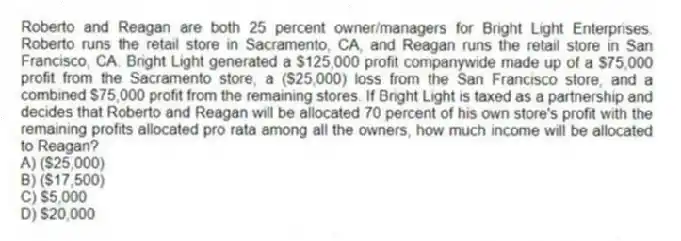

Roberto and Reagan are both 25 percent owner/managers for Bright Light Enterprises. Roberto runs the retail store in Sacramento, CA, and Reagan runs the retail store in San Francisco, CA. Bright Light generated a $125,000 profit companywide made up of a $75,000 profit from the Sacramento store, a ($25,000) loss from the San Francisco store, and a combined $75,000 profit from the remaining stores. If Bright Light is taxed as a partnership and decides that Roberto and Reagan will be allocated 70 percent of his own store's profit with the remaining profits allocated pro rata among all the owners, how much income will be allocated to Reagan?

A) ($25,000)

B) ($17,500)

C) $5,000

D) $20,000

Correct Answer:

Verified

Q32: On which form is income from a

Q43: Generally, which of the following flow-through entities

Q43: When an employee/shareholder receives a business income

Q47: What tax year-end must an unincorporated entity

Q50: Crocker and Company (CC)is a C corporation.

Q50: Which of the following statements is False

Q51: On which tax form do LLCs with

Q54: Which of the following legal entities are

Q57: The deduction for qualified business income applies

Q60: Which of the following entity characteristics are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents