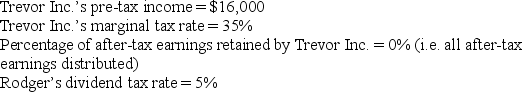

Rodger owns 100% of the shares in Trevor Inc.,a C corporation.Assume the following for the current year:

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Q60: When an employee/shareholder receives an income allocation

Q61: Jamal Corporation,a C corporation,projects that it will

Q63: In its first year of existence Aspen

Q64: Corporation A owns 10% of Corporation C.The

Q66: Cali Corp.(a C corporation)projects that it will

Q67: Nancy purchased a building and then leased

Q68: For the current year,Creative Designs Inc.,a C

Q69: In its first year of existence, BYC

Q69: Tuttle Corporation (a C corporation)projects that it

Q70: For the current year,Birch Corporation,a C corporation,reports

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents