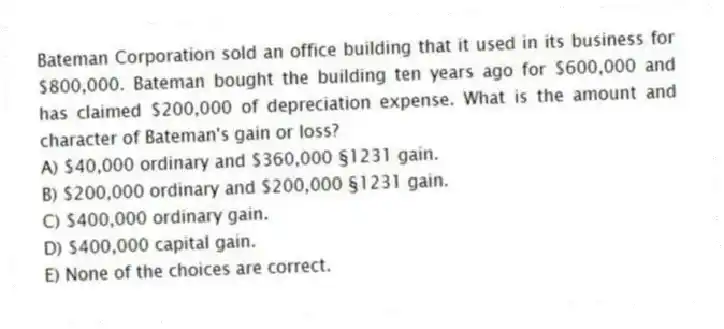

Bateman Corporation sold an office building that it used in its business for $800,000. Bateman bought the building ten years ago for $600,000 and has claimed $200,000 of depreciation expense. What is the amount and character of Bateman's gain or loss?

A) $40,000 ordinary and $360,000 §1231 gain.

B) $200,000 ordinary and $200,000 §1231 gain.

C) $400,000 ordinary gain.

D) $400,000 capital gain.

E) None of the choices are correct.

Correct Answer:

Verified

Q41: Which of the following gains does not

Q44: Which of the following sections recaptures or

Q47: Which of the following does not ultimately

Q48: The sale of land held for investment

Q51: Which of the following transactions results solely

Q53: Brad sold a rental house that he

Q54: Which of the following is not a

Q54: Leesburg sold a machine for $2,200 on

Q55: Which of the following results in an

Q58: Bozeman sold equipment that it uses in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents