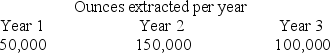

Lucky Strike Mine (LLC) purchased a silver deposit for $1,500,000.It estimated it would extract 500,000 ounces of silver from the deposit.Lucky Strike mined the silver and sold it reporting gross receipts of $1.8 million,$2.5 million,and $2 million for years 1 through 3,respectively.During years 1 - 3,Lucky Strike reported net income (loss) from the silver deposit activity in the amount of ($100,000) ,$400,000,and $100,000,respectively.In years 1 - 3,Lucky Strike actually extracted 300,000 ounces of silver as follows:  What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?

A) $200,000

B) $375,000

C) $400,000

D) $450,000

E) None of the choices are correct.

Correct Answer:

Verified

Q63: Which of the following assets is eligible

Q68: Daschle LLC completed some research and development

Q69: Bonnie Jo purchased a used computer (5-year

Q71: Geithner LLC patented a process it developed

Q72: Arlington LLC purchased an automobile for $40,000

Q73: Littman LLC placed in service on July

Q76: Lenter LLC placed in service on April

Q77: Billie Bob purchased a used computer (5-year

Q78: Crouch LLC placed in service on May

Q94: Janey purchased machinery on April 8th of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents