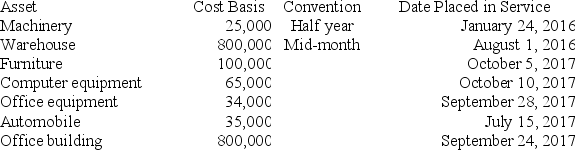

Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2016 and 2017:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016,but would like to elect §179 expense for 2017 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2017,(ignore bonus depreciation for 2017).If necessary,use the 2016 luxury automobile limitation amount for 2017.(Use MACRS Table 1 and Use MACRS Table 5)Exhibit 2-8 (Round final answer to the nearest whole number)

Correct Answer:

Verified

§179 allows expensing of all th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Yasmin purchased two assets during the current

Q81: Northern LLC only purchased one asset this

Q84: Olney LLC only purchased one asset this

Q84: Eddie purchased only one asset during the

Q87: Alexandra purchased a $35,000 automobile during 2017.The

Q88: Kristine sold two assets on March 20th

Q90: Columbia LLC only purchased one asset this

Q91: During April of the current year, Ronen

Q96: Bonnie Jo used two assets during the

Q98: Amit purchased two assets during the current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents