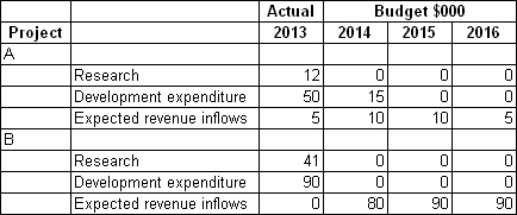

Serendipity Ltd is working on two independent research and development projects.Project A has recently been fruitful and the resulting product has been marketed,unfortunately with limited success.Development of the product is continuing in an effort to improve its marketability.Project B is due for product release in one year's time.The initial marketing surveys and forward contracts suggest that the outcome for this product is very favourable.The following information relates to the expenditures for the current period and budgeted figures for the next 3 years.All research costs in prior periods were expensed.The budgeted figures are considered accurate beyond a reasonable doubt.  What is the research and development deferral for each project in 2013?

What is the research and development deferral for each project in 2013?

A) Project A $5000; Project B $0

B) Project A $47 000; Project B $131 000

C) Project A $30 000; Project B $90 000

D) Project A $62 000; Project B $131 000

Correct Answer:

Verified

Q33: As part of adopting IFRS,goodwill acquired in

Q34: Buster Plc had purchased goodwill to the

Q39: Broadbeach Plc is a manufacturing company

Q40: Far-flung Co Ltd purchases Local Co

Q41: Outline the requirements of IAS 38 on

Q43: Brighton Shores Plc has a cash

Q55: Which of the following combination best demonstrates

Q57: After initial recognition,the acquirer shall recognise goodwill

Q58: Which of the following expenses are likely

Q66: Explain why intangible assets are required to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents