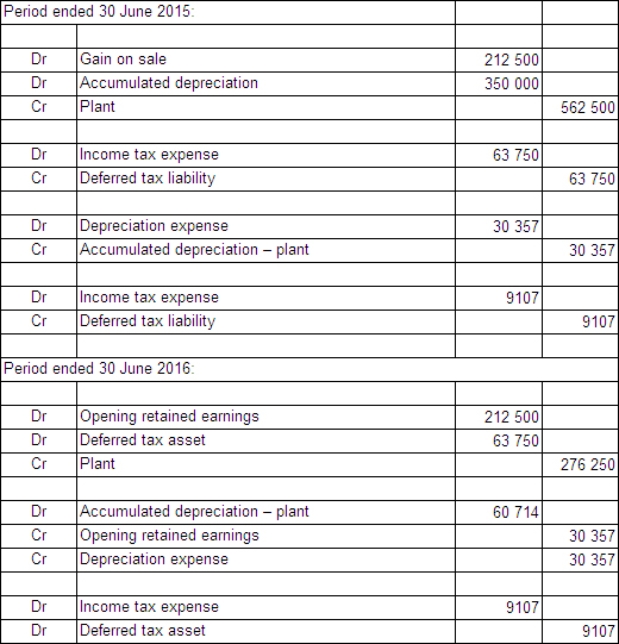

Apple Plc owns all the issued capital of Pear Plc.On 1 July 2014,Pear Plc purchased an item of plant from Apple Plc for £1 000 000.Apple Plc had owned the plant for 5 years.It originally cost £1 350 000 and the accumulated depreciation at 1 July 2004 is £562 500.The remaining useful life of the equipment on the date of sale to Pear Ltd is estimated to be 7 years.The pattern of benefits is expected to be obtained from the equipment evenly over its useful life.The tax rate is 30%.Round all calculations to the nearest dollar. What are the consolidation journal entries required for this inter-company transaction for the periods ended 30 June 2015 and 30 June 2016?

A)

B)

C)

D)

Correct Answer:

Verified

Q28: Companies A,B and C are all part

Q34: The journal entries to eliminate unrealised

Q35: Zeus Plc owns 100% of the

Q36: Aladdin Plc sold inventory items (with a

Q38: Hammer Ltd acquired all the issued

Q40: Lilo Plc sells inventory items to its

Q42: Detail at least five types of intragroup

Q43: Explain,with examples,the difference between dividend payments out

Q47: Explain the accounting treatment for impairment to

Q49: Explain,with examples and the assumptions made,why it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents