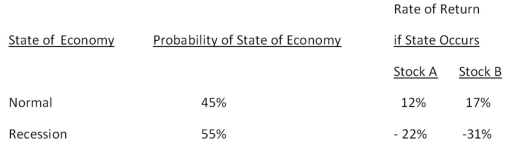

You are comparing stock A to stock B.Given the following information,what is the difference in the expected returns of these two securities?

A) -0.85 percent

B) 2.70 percent

C) 3.05 percent

D) 13.45 percent

E) 13.55 percent

Correct Answer:

Verified

Q65: The returns on the common stock of

Q67: You own a portfolio with the

Q67: The common stock of Manchester & Moore

Q68: You own the following portfolio of stocks.What

Q69: What is the standard deviation of the

Q70: The rate of return on the common

Q72: What is the standard deviation of the

Q73: What is the expected return on a

Q74: What is the variance of the returns

Q75: What is the expected return on this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents