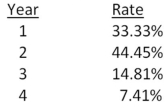

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

A) $537.52

B) $1,347.17

C) $1,569.86

D) $1,929.11

E) $2,177.56

Correct Answer:

Verified

Q68: Bruno's Lunch Counter is expanding and expects

Q68: You just purchased some equipment that

Q69: Bernie's Beverages purchased some fixed assets

Q69: A proposed expansion project is expected to

Q70: Jasper Metals is considering installing a new

Q72: The Lumber Yard is considering adding a

Q72: You own some equipment that you

Q75: Gateway Communications is considering a project with

Q77: You are working on a bid to

Q79: Automated Manufacturers uses high-tech equipment to produce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents