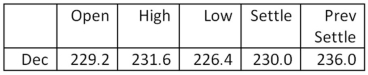

You are the purchasing agent for a major cookie company.You anticipate that your firm will need 20,000 bushels of oats in December.You decide to hedge your position today and did so at the closing price of the day.Assume that the actual market price turns out to be 228.0 on the day you actually buy the oats.How much did you gain or lose by hedging your position?

Oats - 5,000 bu.:

Cents per bu.

A) lost $4,000

B) lost $400

C) saved $40

D) saved $400

E) saved $4,000

Correct Answer:

Verified

Q41: Which one of the following obligates you

Q42: Suppose you purchase a September cocoa futures

Q42: If a firm creates an interest rate

Q43: You are a jewelry maker.In May of

Q44: Most of the evidence to-date indicates that

Q45: You purchased four April futures contracts on

Q47: You own three January futures contracts on

Q48: You decided to speculate in the market

Q49: You own shares of a stock and

Q50: You believe the price of a stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents