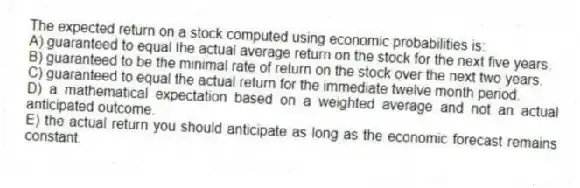

The expected return on a stock computed using economic probabilities is:

A) guaranteed to equal the actual average return on the stock for the next five years.

B) guaranteed to be the minimal rate of return on the stock over the next two years.

C) guaranteed to equal the actual return for the immediate twelve month period.

D) a mathematical expectation based on a weighted average and not an actual anticipated outcome.

E) the actual return you should anticipate as long as the economic forecast remains constant.

Correct Answer:

Verified

Q3: Which one of the following is a

Q4: The standard deviation of a portfolio:

A) is

Q5: The expected risk premium on a stock

Q6: Which one of the following statements is

Q7: Which one of the following is an

Q9: Steve has invested in twelve different stocks

Q10: You own a stock that you think

Q11: The standard deviation of a portfolio:

A) is

Q12: Which one of the following statements is

Q13: Which one of the following is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents