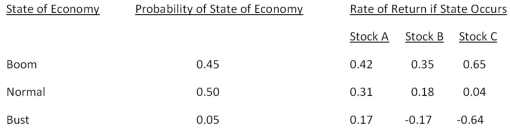

Consider the following information on three stocks:  A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

A portfolio is invested 35 percent each in Stock A and Stock B and 30 percent in Stock C.What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3 percent?

A) 11.47 percent

B) 12.38 percent

C) 16.67 percent

D) 24.29 percent

E) 25.82 percent

Correct Answer:

Verified

Q99: Your portfolio is comprised of 40 percent

Q100: Which one of the following stocks is

Q101: Consider the following information on Stocks I

Q102: Explain how the beta of a portfolio

Q103: A portfolio beta is a weighted average

Q104: Suppose you observe the following situation:

Q105: Suppose you observe the following situation:

Q107: According to CAPM,the expected return on a

Q108: Explain the difference between systematic and unsystematic

Q109: Explain how the slope of the security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents